1. Introduction

According to the National Environment Agency (NEA), Singapore’s household electricity consumption has increased by about 17 per cent over the past decade [1]. A 2017 NEA survey of 550 households found that air-conditioners were largely to blame, accounting for about 24 per cent of the consumption of a typical home [1]. However, it remains unknown if households currently use their air-conditioners out of habit (e.g. turning on the air-conditioner every day), or when the need arises. In addition, when referenced against the surface air temperature, there might be a delay in turning on the air-conditioner as our sensation of heat depends not only on temperature, but other factors such as humidity, cloud cover, sun intensity and wind [2]. Hence, the intent of this study is to investigate if there is a relationship between household electricity consumption and the surface air temperature in Singapore.

2. Hypothesis

This study hypothesises that:

- Household Electricity Consumption in Singapore is influenced by the Surface Air Temperature of Singapore

- There are no appreciable lags between the two variables

3. Data Sources

Table 1: Data Sources

| Variable | Frequency | Source | URL |

| Mean Surface Air Temperature | Monthly | National Environment Authority | https://data.gov.sg/dataset/surface-air-temperature-monthly-mean |

| Household Electricity Consumption | Monthly | Energy Market Authority | https://data.gov.sg/dataset/monthly-electricity-consumption-by-sector-total |

To perform analysis on these variables, data sources with the same time resolution was first obtained from data.gov.sg. The Mean Surface Air Temperature was obtained from the “Surface Air Temperature – Monthly Mean” dataset published by NEA, whereas the Household Electricity Consumption was obtained from the “Monthly Electricity Consumption by Sector” dataset published by the Energy Market Authority (EMA) of Singapore.

It was noted that “Monthly Household Electricity Consumption” records are only available till September 2015. Hence, this study utilised data from October 2010 to September 2015 (5 years), providing a total of 60 data points for analysis.

4. Analysis of Input Series

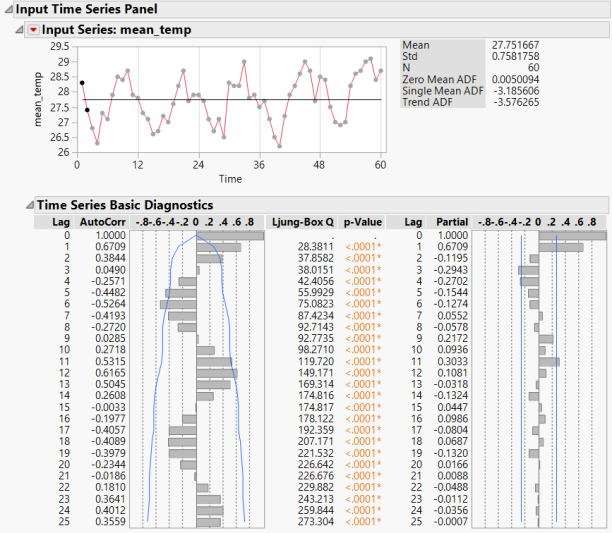

4.1 Pre-whitening of Input Series

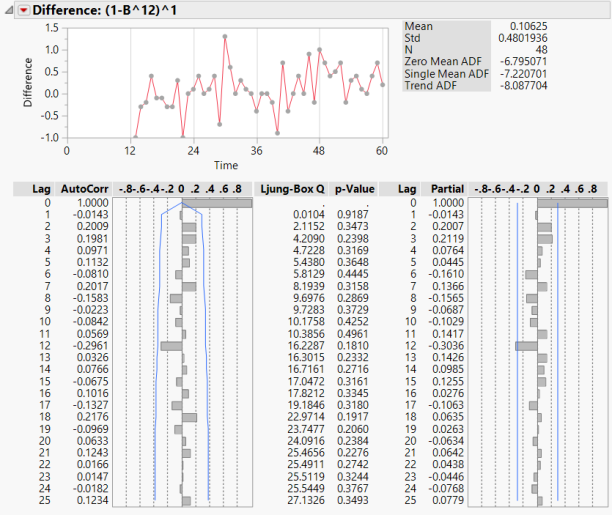

Based on our hypothesis indicated in section 2, the input series was taken to be Mean Surface Air Temperature. Initial inspection of the data reveals that the data was stationary. However, based on the time series and the Autocorrelation Function (ACF) plots, a 12-month seasonality was observed. This is consistent with the knowledge that weather in Singapore follows a 12-months cycle, largely characterised by two monsoon seasons – the Northeast Monsoon (December to early March) and the Southwest Monsoon (June to September) [3]. As such, the first step is to apply a first order seasonal differencing of 12 months to the input series.

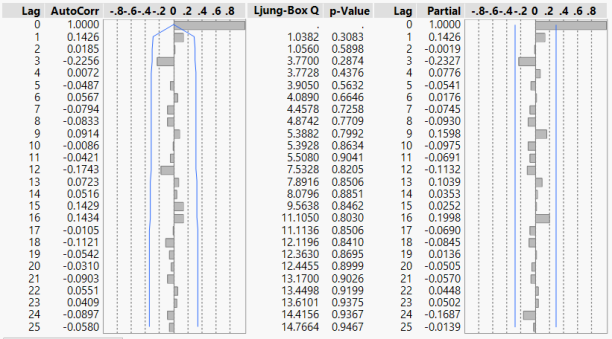

The resulting Autocorrelation Function (ACF) and Partial Autocorrelation Function (PACF) plots (Figure 2) indicated that the resulting residuals are white noise. Hence, the Seasonal Difference model built for the input series is taken to be (0,0,0),(0,1,0)12 at this stage.

5. Analysis of Output Series

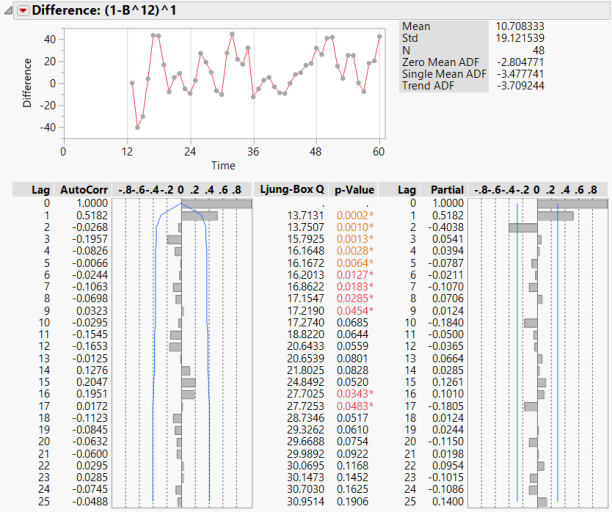

5.1 Pre-whitening of Output Series

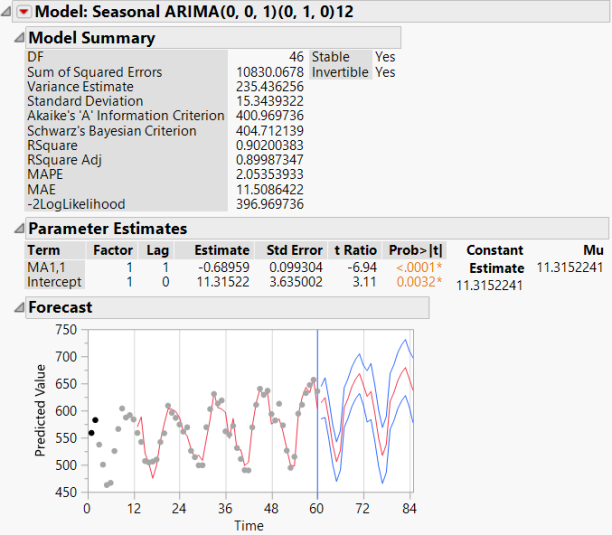

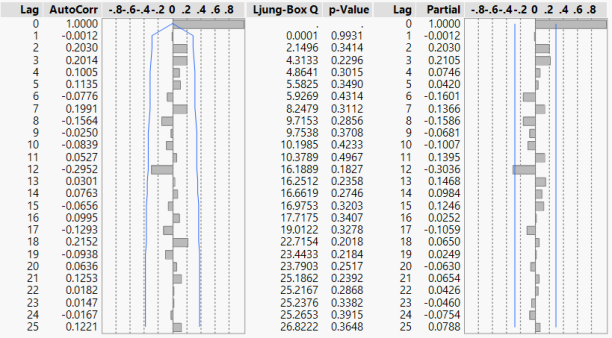

With the Seasonal Difference Model for the input series identified in section 4.1, the output series (Household Electricity Consumption) was pre-whitened with the same model. Based on the ACF and PACF plots in Figure 3, it’s observed that the PACF plot is dying down, while the ACF plot cuts off at the first lag. As such, a MA(1) term was added to the Seasonal Difference model in an attempt to achieve white noise residuals.

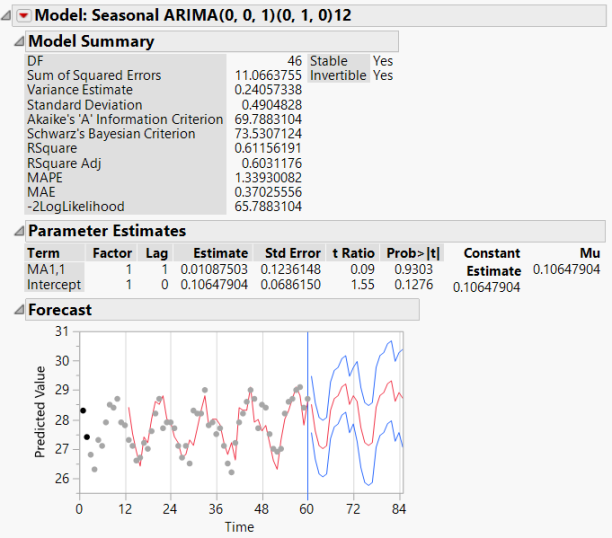

From Figure 4, it was observed that the MA(1) term added was significant. The Akaike’s ‘A’ Information Criterion (AIC) was deemed acceptable, and the model managed to accurately model the 60 points to project a forecast that not only repeats the trend, but also has a tight confidence interval. The residuals of this (0,0,1),(0,1,0)12 IMA Model has also achieved white noise as evidenced in the ACF and PACF plots in Figure 5. Hence, the IMA model built for the output series is taken to be (0,0,1),(0,1,0)12 at this stage.

5.2 Verification of white noise residuals on Input Series

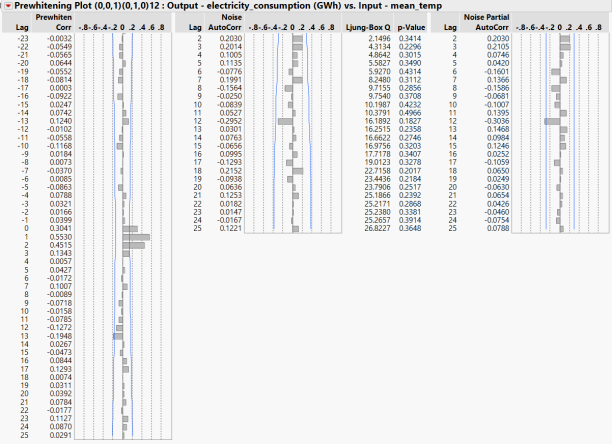

Since the input series was previously pre-whitened with a (0,0,0),(0,1,0)12 Seasonal Difference model, the IMA model (0,0,1),(0,1,0)12 developed for the output series was applied to the input series to verify that pre-whitening the input series with the output IMA model would still result in white noise residuals.

Based on Figure 6, it was observed that the residuals remained as white noise. In addition, it was observed that the additional MA(1) term added is not significant. This was assessed to be reasonable, as the original input series didn’t require this MA(1) term during the previous pre-whitening stage to achieve white noise. Hence, the final model chosen is a (0,0,1),(0,1,0)12 IMA Model.

6. Transfer Function Modelling

6.1 Cross-correlation between Pre-Whitened Series

With the (0,0,1),(0,1,0)12 IMA model finalised in section 5.2, the cross correlation between the pre-whitened input and output series was computed. From the results shown in Figure 8, significant correlation was observed between lag 0 to 2. Hence, the transfer function model will resemble the following equation:

![]()

where are the transfer function weights to be determined.

6.2 Transfer Function Model Parameters

An alternate method to represent the model would be as follows:

![]()

where

In order to determine the transfer function model, the parameters b, s and r must first be identified. From Figure 8, it was shown that the first non-zero correlation starts at lag 0, which means that the input and output series are in sync. As such, b = 0. Meanwhile, the cross correlation peak was observed at lag 1. Hence, s = 1. Lastly, it was noted that the cross correlation seemed to be oscillating about 0 in the pre-whitening plot. Hence, r = 2 was selected.

6.3 Transfer Function Model Evaluation

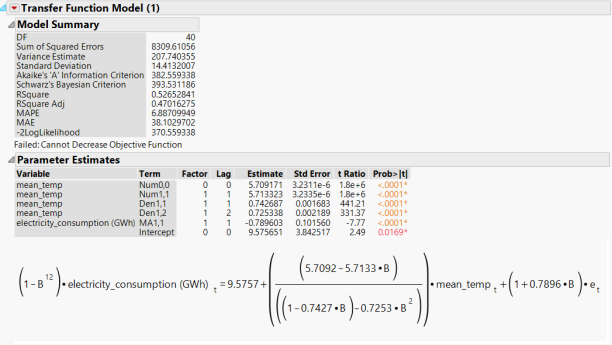

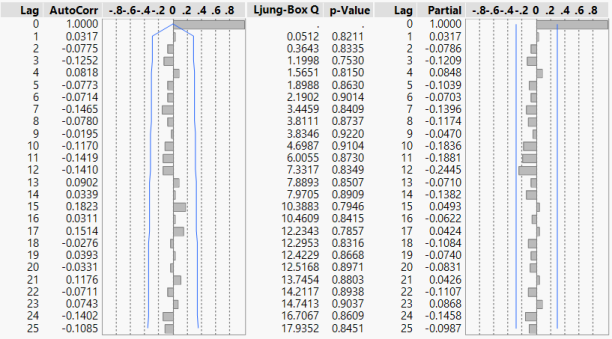

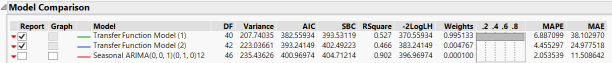

With the transfer function model parameters selected in the previous section, the model was fitted and evaluated. From Figure 9, it was observed that both the AIC and Schwarz’s Bayesian Criterion (SBC) are reasonably small, and the parameters used in fitting the models were all statistically significant. Figure 10 also shows that the residuals of this transfer function model was white noise. Compared with an alternate transfer function model where r = 1 (b = 0, s = 1, r = 1), this model was assessed to be better in terms of AIC and SBC. Hence, the final transfer function model parameters selected was (b = 0, s = 1, r = 2).

7. Relationship between Household Electricity Consumption and Mean Surface Air Temperature

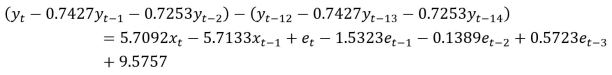

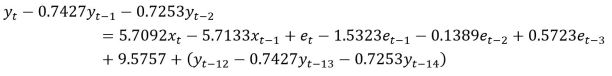

Based on the pre-whitening plot in Figure 8, it was initially concluded that there was no lag between Household Electricity Consumption (y) and Mean Surface Air Temperature (x). However, expansion of the transfer function model shown in figure 9 yields the following relationship:

This shows that while there is no lag between x and y, past values of both variables also impact y. More importantly, it was observed that the coefficients of each y term are the same with itself 12 months ago. Rearranging the above formula gives the following:

This means that while yt-1, yt-2, xt, xt-1, et, et-1, et-2 and et-3 may explain the variability in y, an offset from last year’s set of y terms is required for it to fully explain yt. This indicates an upward trend in household electricity consumption, assuming mean surface air temperature remains the same every season.

8. Conclusion

This study hypothesizes that there is an instantaneous unidirectional relationship between the mean monthly surface air temperature of Singapore, and the monthly household electricity consumption in Singapore. While some believe that human behaviour such as being cost conscious or simply the lack of awareness of rising temperatures may influence and possibly delay the decision to switch on the air-conditioner, time series transfer function modelling of these two variables confirms that (1) household electricity consumption is influenced by mean surface air temperature and (2) they are moving in phase. It was further observed that there is a rising trend in the household electricity consumption in Singapore, as household electricity consumption is autocorrelated with its previous season.

9. References

[1] A. Zhaki, “Singapore’s household electricity consumption up 17 per cent over past decade,” The Straits Times, Singapore, 05-May-2018.

[2] AccuWeather, “The AccuWeather RealFeel Temperature,” 2011. [Online]. Available: https://www.accuweather.com/en/outdoor-articles/outdoor-living/the-accuweather-realfeel-tempe/55627. [Accessed: 18-Sep-2018].

[3] Meteorological Service Singapore, “Climate of Singapore.” [Online]. Available: http://www.weather.gov.sg/climate-climate-of-singapore/. [Accessed: 18-Sep-2018].

| Team Name | Zero |

| Student ID | Name |

| A0178551X | Choo Ming Hui Raymond |

| A0178431A | Huang Qingyi |

| A0178415Y | Jiang Zhiyuan |

| A0178365R | Wang Jingli |

| A0178329R | Wong Yeng Fai, Edric |

| A0178371X | Yang Shuting |